Meta and Corning have signed a multi-year supply agreement worth up to $6 billion to support Meta’s US data center expansion, with Corning supplying optical fibre, cable, and connectivity hardware. As part of the deal, Corning plans to expand manufacturing in North Carolina, including a major capacity increase at its optical cable facility in Hickory, where Meta will act as the anchor customer. “This long-term partnership with Meta reflects Corning’s commitment to develop, innovate, and manufacture the critical technologies that power next-generation data centers here in the US,” said Wendell P. Weeks, chairman and CEO of Corning Incorporated.

The investment is expected to increase Corning’s headcount in North Carolina by 15% to 20% and support a workforce of more than 5,000 across its optical fibre and cable operations. Meta is ramping up US data center investment and prioritising domestic manufacturing, with Joel Kaplan, Meta’s chief global affairs officer, stating that building advanced US data centres requires “world-class partners,” while the agreement gives Meta greater certainty over fibre supply and delivery timelines as it scales AI-driven data center deployments.

FULL ARTICLE

Digital Edge plans to invest $4.5 billion to develop the 500MW CGK Campus hyperscale data center in Indonesia, to be built at the Greenland International Industrial Center near Jakarta. The campus will be developed in phases and could scale to 1GW over time, targeting AI workloads with direct-to-chip liquid cooling, recycled water systems, renewable energy integration, and an annualised PUE of 1.25. Phase one will comprise three buildings, with the first due to be ready for service in Q4 2026, followed by the second in Q1 2027 and the third in Q2 2027.

“The CGK Campus is a pivotal milestone in our APAC strategy and our largest infrastructure investment to date,” said John Freeman, CEO of Digital Edge. “This landmark investment will enable us to drive the next decade of innovation, cloud adoption, and digital services across Indonesia and the broader region.” Stephanus Oscar, CEO of Digital Edge Indonesia, added: “Indonesia’s digital economy is expanding faster than infrastructure can keep up. The CGK Campus bridges that gap with 500MW of sustainable, carrier-neutral capacity built for hyperscale and AI deployments.”

FULL ARTICLE

Pacifico Energy has secured an air permit from the Texas Commission on Environmental Quality authorising up to 7.65GW of gas-fired power generation for its GW Ranch project in West Texas, a private-grid power campus designed specifically to serve hyperscale and AI data centres. The 8,000-acre site will also include 1.8GW of battery storage and 750MWac of solar power, with Phase 1 expected to deliver 1GW of capacity by the first half of 2027.

“As Texas solidifies its role as a leading market for data centre expansion, this 7.65 GW TCEQ air permit underscores our ability to deliver the scale, speed, and regulatory certainty that hyperscale and other large-load customers require,” said Nate Franklin, CEO of Pacifico Energy Group, while vice president Constantyn Gieskes added: “Receiving TCEQ approval for the largest power project in the United States is a defining milestone for GW Ranch, and clears a critical path for delivering power at a scale the market urgently needs.”

FULL ARTICLE

Google has received permitting approval to develop a long-anticipated data center in Kronstorf, Austria, nearly 20 years after acquiring the 70-hectare site in 2008, marking the company’s first owned data center facility in the country. “The building law procedure for Google’s project has been completed and has been approved,” said Christian Kolarik, Mayor of Kronstorf, adding that “Google has submitted a concrete project to both the trade authority – the Linz-Land district – and the building authority – the municipality of Kronstorf,” with construction expected to begin soon on a main building of around 29,000 square metres. While Google has not disclosed investment details, the move comes as Austria’s data center market continues to grow amid rising AI and cloud demand, alongside recent expansions by other hyperscalers such as Microsoft.

FULL ARTICLE

The UAE’s Stargate AI data centre project is now expected to cost more than $30 billion, according to Omar Al Olama, the country’s Minister of State for AI, digital economy and remote work applications. The five-gigawatt project in Abu Dhabi—backed by major global tech players—covers 19.2 square kilometres and is positioned as a flagship initiative to strengthen international cooperation in AI infrastructure. The revised estimate is around 50% higher than the original $20bn forecast made in early 2025.

Al Olama said Stargate reflects the UAE’s ambition to lead in AI not just commercially, but strategically, including exporting AI capabilities and supporting other nations in building or accessing large language models. He emphasized data sovereignty as a core goal, noting the UAE wants to offer countries AI infrastructure and models that prioritize national control and long-term capability over profit or short-term commercial gain.

FULL ARTICLE

A gigawatt-scale, off-grid data center campus has been proposed for Olds, Alberta, by newly formed Synapse Data Center Inc. The project would comprise ten 100MW buildings totaling around two million sq ft, powered by a closed-cycle natural gas system and not connected to the local grid, with closed-loop cooling. The campus could represent up to CA$10 billion in investment, with the first phase potentially ready by mid-2026, and was sited for its access to natural gas, fiber connectivity, and proximity to Calgary, Edmonton, and Red Deer.

“Olds was the clear choice for this $10 billion investment because of the community’s proactive vision and the exceptional responsiveness of Invest Olds and the Town of Olds,” said Jason van Gaal, CEO of Synapse, adding that the project would create more than 1,000 long-term, high-skilled technology jobs. Olds Mayor Dan Daley said: “Olds is proud to be considered for what could become one of the most significant digital infrastructure investments in Canada,” highlighting the economic and tax benefits for the community.

FULL ARTICLE

Meta is forecasting 2026 full-year capex of between $115 billion and $135 billion, up sharply from $72.22bn in 2025, driven largely by data center and AI infrastructure investment. During the company’s Q4 2025 earnings call, CFO Susan Li said the increase reflects “increased investment to support our Meta Superintelligence Labs efforts and core business,” adding that “the majority of expense growth will be driven by infrastructure costs, which includes third-party cloud spend, higher depreciation, and higher infrastructure operating expenses.” Total expenses for 2026 are expected to reach $162–169bn.

Meta has previously warned it would “invest aggressively” in AI data centers and cloud capacity, and Li reiterated that “procuring sufficient infrastructure capacity is central to these initiatives.” CEO Mark Zuckerberg said the company remains “capacity-constrained,” noting that while Meta expects to add significantly more capacity in 2026, constraints will likely persist until new facilities come online later in the year. Meta recently created a new Meta Compute division to manage its AI infrastructure push and has signed major cloud and infrastructure deals, as it works toward building tens of gigawatts of data center capacity this decade.

FULL ARTICLE

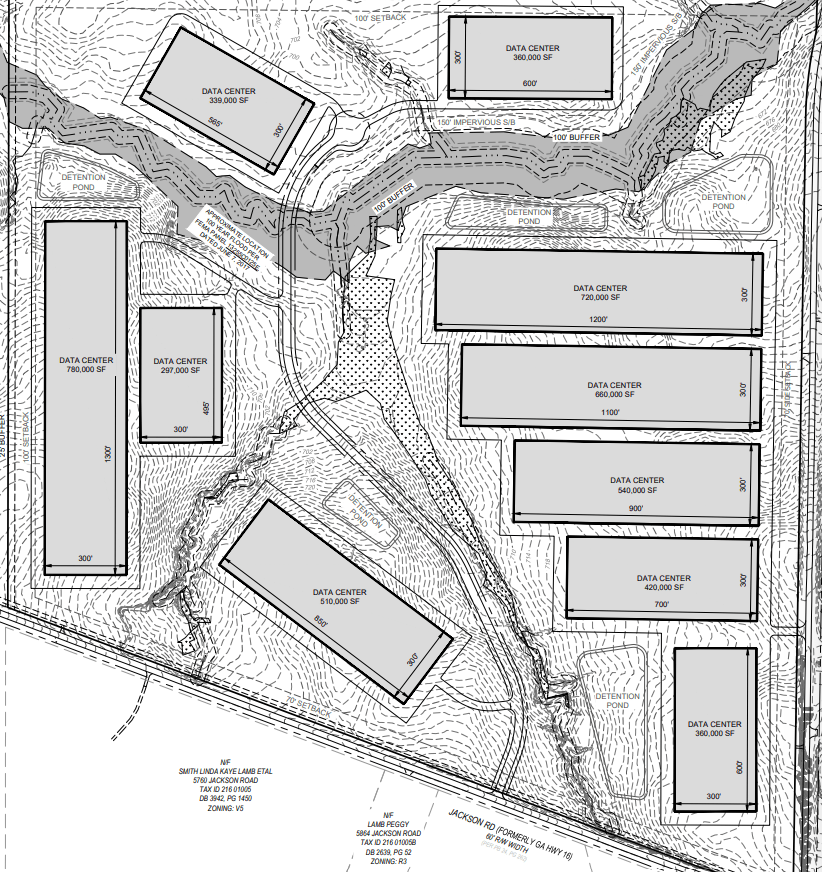

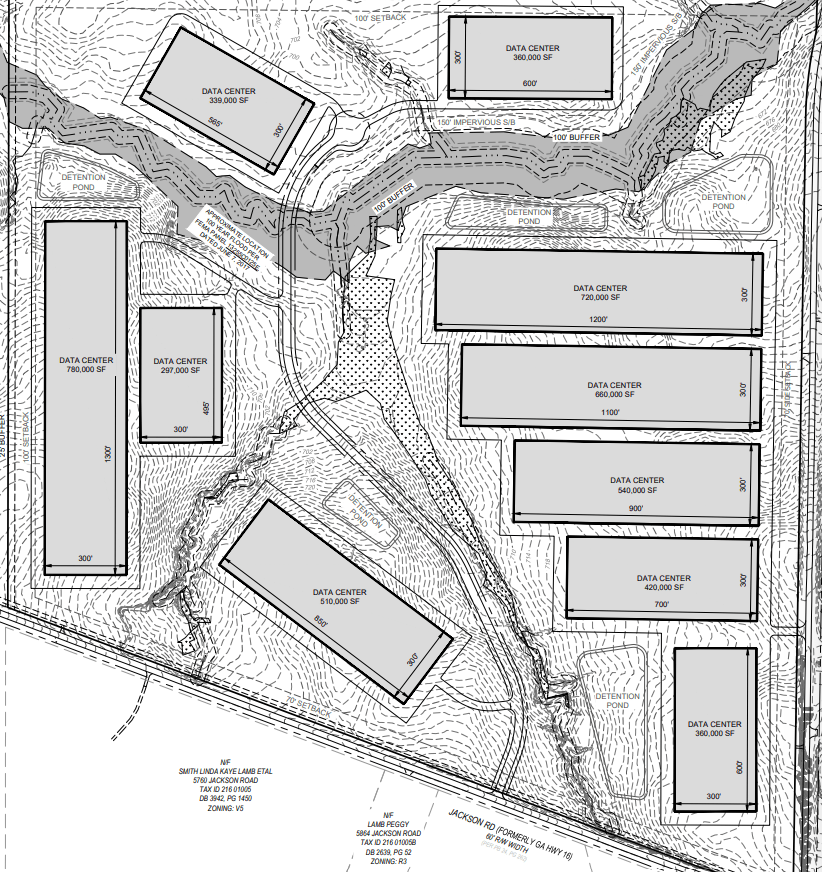

Spalding County, Georgia, has approved another major data center development, this time a $3.9bn project proposed by Wallace Jackson LLC. The 190-acre campus, located on Jackson Road, could include up to ten buildings totaling nearly five million square feet, with full build-out expected by 2035. The land is owned by Havenwood Holdings, linked to local developer Doug Adams.

This approval adds to Spalding County’s growing pipeline of data center projects, as local authorities continue to support developments that generate long-term tax revenue. Two other large campuses were approved in 2025, bringing the county’s total approved data center space to well over eight million square feet and reinforcing its emergence as a secondary data center market south of Atlanta.

FULL ARTICLE

NextEra Energy said it has 20GW of interest from large-load users, largely hyperscale data center customers, with 9GW already in advanced discussions. During its Q4 earnings call, the company outlined plans to deliver 15GW of new generation for data center hubs by 2035 under its “15 by 35” strategy, with 20 hubs currently in development and expectations to reach 40 by the end of the year.

To meet demand, NextEra added 8.7GW of new generation in 2025, including a record 3.6GW in Q4, and now has around 30GW in its interconnection backlog, one-third of which is battery storage. The company is also evaluating 6GW of small modular reactor co-location opportunities and has signed major long-term energy agreements with hyperscalers, including expanded partnerships with Google Cloud and Meta to support gigawatt-scale data center growth.

FULL ARTICLE

Oracle has confirmed it will be the tenant of Project Jupiter, a large data center campus under development in Doña Ana County, New Mexico, by Stack and BorderPlex Digital Assets. The 1,400-acre site will include four data center buildings supported by on-site natural gas generation, battery storage, microgrid infrastructure, and a desalination plant, and will be used to host AI infrastructure for OpenAI. Oracle said the project will create around 4,000 construction jobs and 1,500 permanent roles once operational.

The company said it will contribute more than $600 million in gross revenue taxes to the state and county, along with $320 million in direct payments for schools, infrastructure, and local services, plus $50 million for water system improvements. Oracle stated the campus will use closed-loop, non-evaporative cooling and operate on a dedicated microgrid to avoid impacting local water supplies or public electricity rates, though the project is facing legal challenges from local groups over transparency and approval processes.

FULL ARTICLE

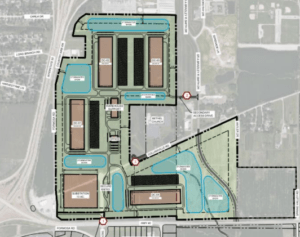

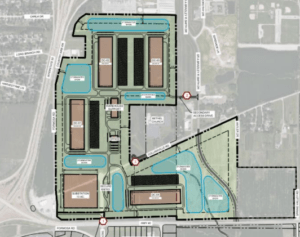

Cloverleaf Infrastructure has proposed a data center campus in Troy, Missouri, northeast of St. Louis, outlining plans during an information session held in early January. The initial concept shows a 250–300 acre site with up to six two-story data center buildings, each around 264,000 sq ft, alongside a substation, office, warehouse, and stormwater infrastructure. A revised full buildout plan would use more of the land but include fewer buildings.

According to local reports, the campus could deliver up to 500MW of capacity once fully built, with completion targeted for late 2028 if construction starts in early 2027. No end user has been disclosed. Founded in 2024, Cloverleaf focuses on acquiring and preparing powered land for data center development and is pursuing projects in several US states, despite recent opposition halting one proposal in Wisconsin.

FULL ARTICLE

AWS is planning a large data center campus in Kline Township, Pennsylvania, proposing up to ten buildings totaling around 2.5 million sq ft on a 346-acre site along Lofty Road. The land, purchased in 2025 for $178 million, was previously approved for a large warehouse project, and AWS says the data center design largely fits within existing zoning, though some permits are still pending. Each building is expected to support roughly 25–30 full-time jobs.

The project aligns with AWS’s broader commitment to invest $20 billion in Pennsylvania data centers, announced in mid-2025, with a primary focus on Salem and Falls Townships but with additional sites under evaluation. AWS has already invested more than $26 billion in the state since 2010 and continues to expand its regional footprint, including plans for up to 15 buildings in Salem Township and interest in nearby Banks Township.

FULL ARTICLE